Maximize the Impact of Your Donation

We're often asked whether the East Grand Rapids Schools Foundation is able to accept donations in the form of stocks, bonds, and mutual funds. The answer is yes. Not only do we accept them, donating securities to the EGR Schools Foundation can be a smart way to maximize the power of your donation.

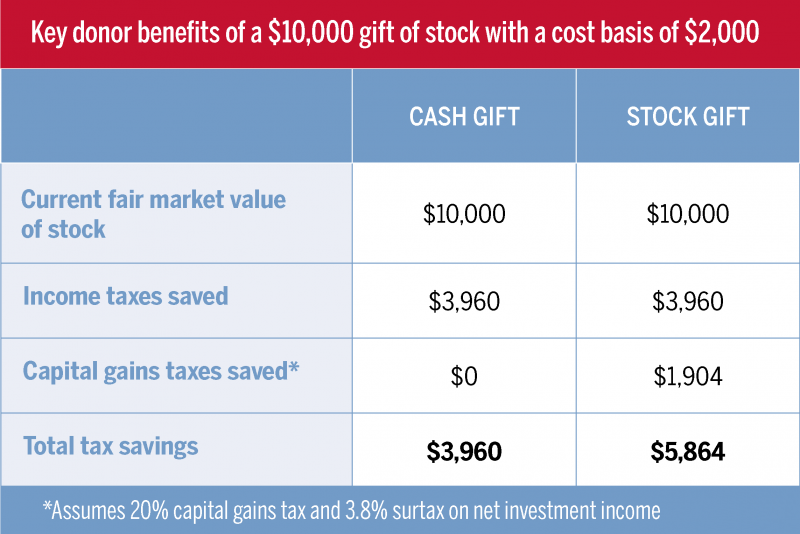

For many investors, strong market performance brings the potential of high capital gains. You can make a bigger impact by donating long-term appreciated securities, including stock, bonds, and mutual funds, directly to the East Grand Rapids Schools Foundation. Not only will your donation be increased, you may receive a greater tax benefit as well.

Compared with donating cash, or selling your appreciated securities and contributing the after-tax proceeds, you may be able to automatically increase your gift and your tax deduction. When you donate stock to the Foundation, you’ll generally take a tax deduction for the full fair market value. And because you are donating stock, your contribution and tax deduction may instantly increase by 15% or more.

If you're interested in donating securities to the Foundation, email Amy Turner-Thole at aturner@egrps.org or call her at (616)235-3535.

(Source: Harvard College Alumni Association)

-

Ray and Kristin Abraham

Ray and Kristin Abraham -

-

-

-

The Bissell/Kruer Family

The Bissell/Kruer Family -

-

-

-

Damian and Sara deGoa

Damian and Sara deGoa -

Ryan and Jamie Duffield

Ryan and Jamie Duffield -

-

-

-

Mike and Julie Dzamba

Mike and Julie Dzamba -

Stephen and Karly Hiser

Stephen and Karly Hiser -

Mark and Staci Koldenhoven

Mark and Staci Koldenhoven -

The Iakiri Family

The Iakiri Family -

-

-

Dave and Linda Mehney Family

Dave and Linda Mehney Family -

Miller Johnson

Miller Johnson -

Matt Richenthal

Matt Richenthal -

-

-

Bill and Barb Saxton

Bill and Barb Saxton -

-

Brian Schwartz and Elizabeth Welch

Brian Schwartz and Elizabeth Welch -

Joan Secchia Nowak

Joan Secchia Nowak -

Tracy and Bob Wolford

Tracy and Bob Wolford